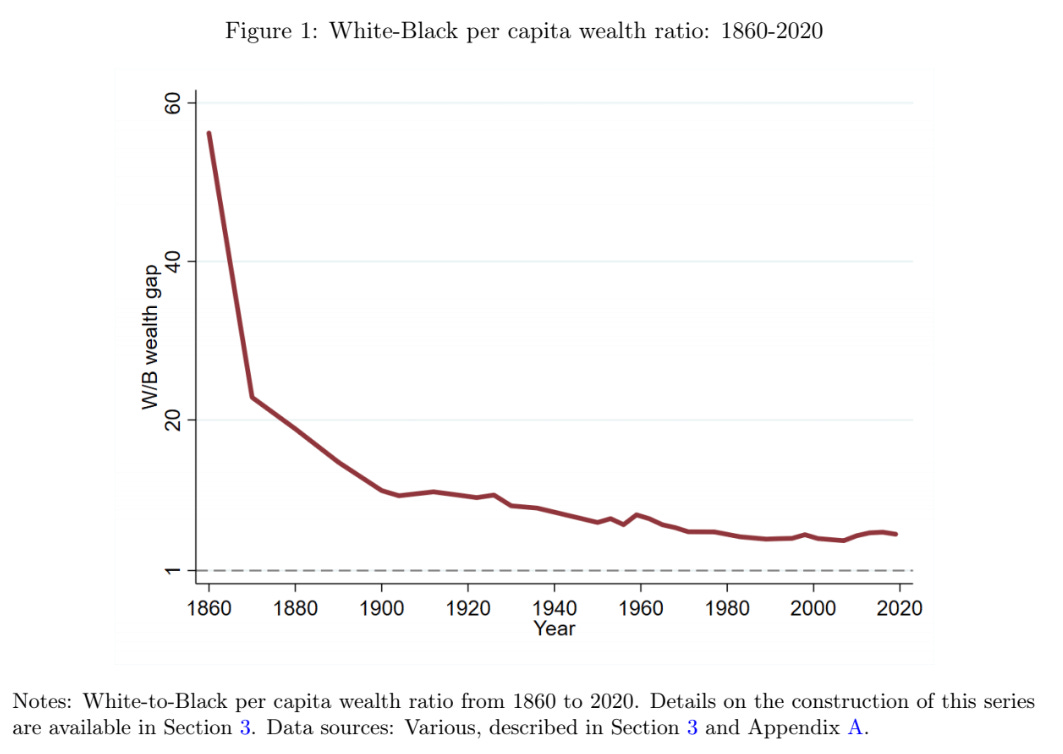

I really love Derenoncourt et al. 2022. The study features a stunning graph – one which, to me, makes the case for reparations all on its own:

In 1860, during chattel slavery, the average Black person’s wealth was just 1/55th of the average White person. In 1870, after 4 million Black people were freed without reparations, the average Black person’s wealth doubled. As a result: In 2020, one and a half centuries later, the average Black person still owned just 1/6th as much as the average White person.

The role of reparations here seems obvious: The United States could have decimated the Black-White wealth gap through reparations to freed Black people. We didn’t then, because Andrew Johnson and White conservatives nixed the plans. We should today.

What caused the Black-White wealth gap?

Derenoncourt et al. don’t just estimate the wealth gap for Black and White Americans. They also show that this gap is a mechanical result of four factors:

Lower starting wealth (W)

Lower capital gains rate (q), return on investment

Lower savings rate (s), percent of income invested

Lower labor income (Y)

None of these are surprising: They’re all just standard parameters in models of wealth growth. But they explain why Black wealth lagged White wealth.

Lower starting wealth is the biggest factor. Even if Black and White Americans had had equal ability to build wealth – identical return on investment (q), identical savings rate (s), and the observed slow convergence of labor income – the Black:White wealth gap would still remain 1:3 today.

In short: Black people today are poor because freedmen were deeply poor. Again, the role of reparations seems obvious.

Why did Black wealth grow more slowly?

Institutional and interpersonal bigotry made it far harder for Black people to build wealth. For each of the four factors, Black people were systematically denied equality:

Lower starting wealth: Freedmen started out 100 times poorer than White Americans.

Lower capital gains rate: Americans build wealth through three routes: Business ownership, home ownership, and stock ownership.

Black-owned businesses faced dozens of legal restrictions, especially during Jim Crow. For example, until the 1960s, restrictive covenants forced most Black businesses into poor neighborhoods. Even today, Black-owned and women-owned firms have a much harder time getting loans.

Black homeowners had to pay much more expensive loans to buy homes in segregated Black regions, where they grew slower in value. As segregation eased, Black homeowners who wanted to buy homes in White regions had to pay a 30% premium and lose 10% of the home’s value. Although anti-Black housing discrimination has declined, it still substantially increases Black mortgage costs.

Stocks are a risky, high-yield asset. Wealthy people can weather that risk, while poor people cannot. That’s why the top 1% own 55% of stock-market wealth and the top 10% own 90%. Until the 1990s, over 95% of poor households owned no financial assets – and most Black households had little way to escape poverty.

Lower savings rate: All of the above gave Black people less reason to invest. In addition, Black investors risked physical destruction of their property, as in the 1921 Tulsa race massacre or 1906 Atlanta race massacre. As discrimination has declined, Black savings rates have grown faster than White savings rates.

Lower labor income: Segregation of schools and labor markets enormously lowered Black incomes. When schools were desegregated, integrated Black students saw a 30% increase in annual earnings (no decline for integrated White students). Before Woodrow Wilson, Black and White civil servants had similar wages. After Wilson segregated the federal service, federal Black wages declined by 7%.

The impact of discrimination on Black wealth is obvious from Derenoncourt et al.’s data. During the 1870s-1890s, newly freed Black people rapidly expanded their wealth from an extremely low base, even as early anti-Black laws were enacted. During the nadir of Black rights in the 1900s-1920s, Black wealth growth almost stopped. Wealth growth resumed in the 1930’s-1970’s – when Northern liberals, labor-leftists, and Black voters fought for civil rights – but stopped again during the 1980s, as the New Right won power:

In short: The Black-White wealth gap is mostly a mechanical result of past and present anti-Black discrimination and very low wealth for freed Black people.

Why does this matter?

Two reasons.

First: Effective reparations must target the wealth gap, wealth growth, and labor income gap all at once.

Many discussions of reparations are incomplete. Leftists tend to highlight the size of the wealth gap. (For example, US Representative and DSA endorsee Cori Bush drafted a resolution to encourage creation of a reparations study commission, which focuses on the $14 trillion wealth gap between Black and White people.) Liberals tend to highlight the size of the income gap. (For example, statements from US President and centrist Democrat Barack Obama usually pointed to gains in income, employment, and education for Black people during his service.)

Neither of these views is complete. (And, in fairness to Bush and Obama, both argue that racial equality requires sharply reducing both wealth and income gaps.)

To see why, let’s return to Derenoncourt et al.

Some people – often, liberals who oppose any wealth redistribution – envision reparations as massively increased funding for Black schools, Black colleges, Black job training, Black businesses, Black homeowners. In short: A set of programs that decreases Black-White income inequality and increases Black capital gains.

This would achieve wealth equality, but very very slowly. If the Black-White income gap continues to decline at its current speed – and we instantly equalized capital gains rate (q), savings rate (s) – then we will only achieve Black-White income equality by 2200, when the Black-White wealth gap would remain 1:1.8:

Other people envision reparations as a massive, one-time wealth transfer from White to Black people. In short: A mega-check that ends Black-White wealth inequality.

This would not achieve durable equality. If we equalized Black and White per-person wealth tomorrow – without equalizing capital gains rate (q), savings rate (s), or income (Y) and income growth rate (g) – the Black:White wealth gap would grow back to 1:3 within 120 years, under the “real world” scenario below:

Neither the convergence of income nor the equalization of wealth alone is sufficient. Derenoncourt et al. write:

[W]e use our framework to comment on two distinct policy approaches aimed at closing the racial wealth gap, those that target equalization of flow parameters — savings rates, capital gains, and income via income growth rates — versus policies targeting redistribution or equalization of stocks of wealth. […] [T]he former set of [flow-based] policies have limited effects on the racial wealth gap in the near future. [….] [I]n the absence of changes in savings and capital gains gaps, [equalization of wealth stock] would have but a transient effect on the wealth gap.

In short: If we want Black-White economic inequality in our lifetimes, neither slow income-investment convergence nor a single massive wealth transfer is sufficient. Effective reparations must reduce the wealth gap, increase incomes, increase savings, and increase investment returns all at once.

Second: The logic above tells us how to design better egalitarian schemes, not just better reparations.

If you’re a socialist or progressive, you’re probably an egalitarianism fan and abundance enthusiast.

For egalitarians, Black-White economic equality is just the start. We want to build a far more equal society, for everyone, of every ethnicity. We don’t just want to abolish low incomes (poverty). We want to abolish as much inequality of power as possible, which demands the elimination of as much socially-unproductive economic inequality as possible.

The evidence above shows that an effective long-term egalitarian scheme must increase equality of starting wealth, of investment rate of returns, of savings rates, and of labor income. (Otherwise, they will reduce inequality in one area but raise it in another.) How do we do so?

Dozens of policies can shore up each element. I want to briefly highlight how one – a Social Wealth Fund (SWF) – can achieve all four goals through social ownership of wealth.

Wealth: Instead of redistributing wealth from rich to poor, we invest that wealth into a Social Wealth Fund (SWF). This is equivalent to raising everyone’s wealth by the SWF’s value, divided by number of residents. First, the fund is democratically managed. Second, the fund enriches everyone equally.

Rate of return: Because SWFs are enormous – Norway’s Oil Fund is worth $1.6 trillion – they can easily take on high-risk, high-return assets like stocks. This lets them maximize their rate of return. (In contrast, most recipients of a wealth transfer would have to use a mixture of low-risk and high-risk assets.)

Savings rate: If the SWF is funded by taxes, it functions like a forced savings plan. This mechanically reduces inequality in savings rates. (In contrast, evidence on large, sudden wealth transfers, like inheritances, implies that people reduce their labor hours and savings rate.)

Labor income: SWFs can increase personal income in one of two ways: First, by funding a Universal Basic Income (UBI) which supplements every person’s labor income. Second, by funding public spending to achieve truly full employment, which raises worker bargaining power and thus raises labor income.

Social Wealth Funds aren’t perfect. But they are a powerful vehicle to equalize wealth and income, both in the short run and long run.

Unfortunately, I think it’s very unlikely that socialists and progressives can win a federal reparations program for descendants of enslaved Black people in the near future.

Fortunately, effective long-term egalitarian programs and effective reparations programs function similarly: Both compress wealth & income inequality in the short and long term.

This means that any egalitarian programs that we can win -- Medicare For All, social housing, federal minimum wages, even a Social Wealth Fund -- will move us closer to a world of Black-White economic equality. These programs will be hard to achieve -- though, funnily enough, Paul Ryan's reform plan for Social Security would have accidentally invested $500 billion per year in a de-facto SWF.

In short: Effective reparations and effective long-term egalitarian programs have similar characteristics.

Conclusions and shilling

In short: Effective reparations must equalize wealth, wealth growth, and income. If we can’t win reparations, we should fight for egalitarian programs that achieve the same goals, like Social Wealth Funds.

I’m writing blogs on socialist and progressive topics. To support my work:

Subscribe on Substack:

Want to fight for reparations, racial equality, and social ownership of wealth? Join the Democratic Socialists of America.

"We didn’t then, because Andrew Jackson and White conservatives nixed the plans. We should today." Shouldn't this be Andrew Johnson?